Arguably, the biggest story in the fixed income sector over the last year or so has been the Federal Reserve and its monetary policy. Nothing has driven bond prices, yields, and fixed income investor sentiment more than the Fed’s decision to raise, pause, and now cut interest rates. But in focusing on rates, bond investors may have been ignoring another elephant in the room.

And that would be taxes.

The Tax Cuts and Jobs Act (TCJA) of 2017 is set to expire next year, creating an interesting conundrum for bond investors. The uncertainty around the Presidential election throws plenty of gasoline onto the fire. Today’s high yields may not seem so advantageous tomorrow. It’s here that municipals could provide a real edge for not only high tax bracket investors but also investors all along the income ladder.

The Sunsetting Tax Bill

Back during President Trump’s first year of office, the Republican-controlled Congress passed a wide-sweeping tax bill. This included plenty of provisions for both corporations and individuals. The law helped reduce corporate tax rates on a variety of fronts such as repatriation of overseas cash and the standard corporate tax rate. For individuals, it helped create the higher standard deduction we’ve all grown accustomed to using, simplified the number of tax brackets, and ultimately reduced the income tax percentages and bands.

The downside is that the TCJA wasn’t a permanent solution and is set to expire at the end of 2025 unless action is taken.

The issue is that the expiring Tax Cuts law will affect a variety of investors all along the tax bracket scale. It’s easy to see how the top end will be affected by the law’s expiration. After the law sunsets starting in 2026, the top individual marginal income tax rate is scheduled to increase back to 39.6%, up from 37%.

However, other investors will see their tax rates increase. For example, a married couple filing jointly with an income of $300,000 will see their marginal tax bracket increase by 9 full percentage points, from 24% to 33%. Lower-end taxpayers will see an increase of 1% to 2% depending on the bracket. The lucrative child care credit is set to be reduced by 50%, as well as to pre-TCJA levels.

Given the election malaise and overall uncertainty, the path of action with regard to the Tax Cut & Jobs Act is quite unknown. A Trump win and Republican control of Congress would most likely keep many of the bill’s provisions intact. However, a Harris win or split Congress could very well muddy the waters. Right now, there is no clear victor and that uncertainty has an effect on investors’ portfolios.

Munis Could Win Out

The TCJA’s expiration has some unique complications for fixed income investors. That’s because bond interest is taxed at investors’ marginal income tax rates. So, someone in the top tax bracket in the post-TCJA world would lose 39 cents out of every dollar they earn from bonds. This is a problem considering the current high yields on bonds and cash. Yes, investors are earning more, but very soon they will be paying more.

This is where municipal bonds could prove to be a valuable portfolio tool for a variety of investors. Munis are issued by states and local governments. Because of this, Uncle Sam cuts investors a break and the interest from munis is tax-free from federal taxes. In many instances, they can be free from state and local taxes as well.

With the TCJA sunsetting, munis’ tax-free nature becomes even more valuable. This is particularly true when looking at munis’ current tax equivalent yield when compared to other fixed income asset classes such as corporate bonds and Treasuries.

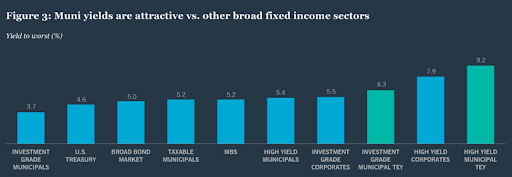

Source: Nuveen

Looking at this chart, you can see that investment-grade municipal bonds and high-yield munis are yielding 3.7% and 5.4%, respectively. However, the tax-free nature provides them additional power. Their taxable equivalent yield (TEY)—or the amount someone would have to earn in another bond type to make the same amount after taxes—is actually 6.3% and 9.2% for someone in the current top tax bracket. The math works similarly for investors along the lower rungs of the tax bracket ladder.

After the TCJA expires, these current TEYs will only increase and make municipal bonds even more desirable.

Additionally, yield compression could help create a strong total return environment for municipal bonds. Demand for munis is set to surge as the sunsetting law ushers more investors into the asset class as a way to lower taxes. This demand is being met with lower overall supplies of munis. High interest rates have dried up new issuance. According to Nuveen, supplies of new munis will mostly match those maturing this year. To quote their research, “the net negative supply creates scarcity among a shrinking pool of outstanding bonds.”

This supply/demand imbalance could finally provide investors with a really strong total return: capital appreciation and yield. The sleepy sector hasn’t experienced this since the Great Recession.

Choose Munis Over Other Bonds

With the TCJA under the chopping block and the uncertainty around its future growing, investors in fixed income markets should consider municipal bonds today, perhaps over other bond types like corporate or even Treasury bonds. The end result is that their embedded tax-free nature makes them invaluable tools to play the uncertainty.

And with lower volatility than other bonds, high credit ratings, and some of the lowest default rates around, munis offer plenty of wins over other fixed income asset classes.

Getting exposure remains the realm of funds and ETFs. Thanks to their large ‘buy 7 hold’ investor base and the fact that they trade on the over the counter markets, munis are pretty tough to purchase individually. The average investor without the help of a professional bond desk will have a hard time adding them to a portfolio. Luckily, there are plenty of great, low-cost ETFs that own the bond type.

Municipal Bond ETFs

These funds were selected based on their exposure to municipal bonds at a low cost. They are sorted by their YTD total return, which ranges from 1.9% to 3%. They have expense ratios between 0.05% to 0.65% and assets under management between $1.2B to $37B. They are currently yielding between 2% and 3.6%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| FMB | First Trust Managed Municipal ETF | $1.9B | 3.0% | 3.2% | 0.65% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1.47B | 2.7% | 3.6% | 0.35% | ETF | Yes |

| MUB | iShares National Muni Bond ETF | $36.8B | 2.2% | 3.0% | 0.05% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond ETF | $34B | 2.2% | 3.2% | 0.05% | ETF | No |

| SUB | iShares Short-Term National Muni Bond ETF | $8.7B | 2.1% | 2.12% | 0.07% | ETF | No |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.9B | 2.1% | 2.2% | 0.20% | ETF | No |

| DFNM | Dimensional National Municipal Bond ETF | $1.23B | 1.9% | 2.2% | 0.19% | ETF | Yes |

All in all, munis already had a great advantage over a variety of bonds and fixed income asset classes. However, with the Tax Cuts & Jobs Act ending without a replacement, their tax-free nature and current high yields are only enhanced. For investors, the time to buy them is now, well ahead of any price increases that occur as the law ends and investors look for solutions to their rising tax bills.

The Bottom Line

Higher taxes give municipal bonds a huge win versus other bond types. Their tax-free nature will allow them to win big when the Tax Cuts & Jobs Act expires. For investors, the time to buy munis is now.